What is an Adjustable Rate Mortgage?

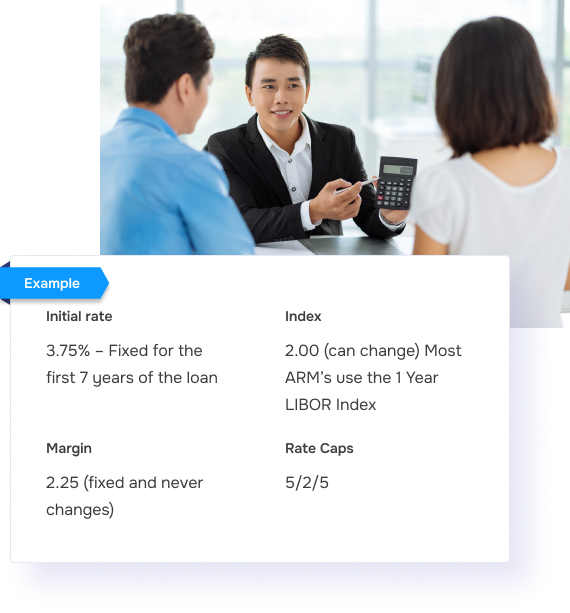

An adjustable rate mortgage or ARM is a loan with a variable interest rate that can change periodically over the course of the loan term. Adjustable-rate mortgages generally have an initial, or “introductory” fixed rate period followed by an adjustable rate period. The fixed rate period can range from as short as 1 month to as long as 10 years.

The most common adjustable rate mortgages are 3/1, 5/1, 7/1 and 10/1 ARMs. The initial 3, 5, 7 or 10 indicate the number of years the initial interest rate is fixed while the second number indicates the loan will adjust annually after the fixed rate period is over. These ARM programs are often referred to as Hybrid ARMs due to the initial fixed rate period.

Get Started

Washington

Washington  Oregon

Oregon